Amazon and other major internet retailers could be hit with a new online sales tax to help the UK pay its debts after extensive borrowing during the pandemic.

Treasury sources confirmed Chancellor Rishi Sunak is considering targeting companies that have done well out of the pandemic to help pay back UK government debts built up supporting industries through the COVID-19 crisis.

The new tax is being considered as part of a business rates review after a consultation was held last year.

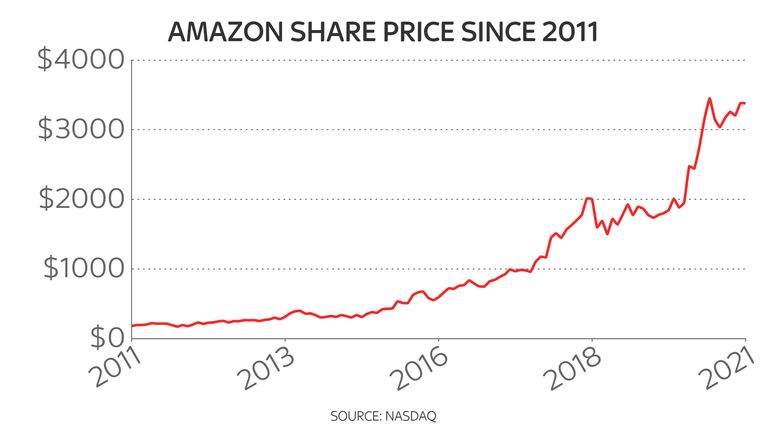

Amazon sales in the UK increased by 51% to nearly £20bn in 2020, as lockdown restrictions forced people to buy online.

ASOS, the online clothes retailer, and food delivery companies such as Deliveroo also benefited, with profits spiking during the various lockdowns over the past year.

Leaked emails showed Treasury officials had summoned tech firms and retailers to a meeting this month to discuss the online sales tax, the Sunday Times reported.

The paper said Downing Street is also looking at introducing an “excessive profits tax” on companies that have seen profits surge due to COVID-19, meaning a double hit for Amazon.

A Treasury spokesman said: “We want to see thriving high streets, which is why we’ve spent tens of billions of pounds supporting shops throughout the pandemic and are supporting town centres through the changes online shopping brings.

“Our business rates review call for evidence included questions on whether we should shift the balance between online and physical shops by introducing an online sales tax. We’re considering responses now.”

Mr Sunak is not expected to propose the tax at his 3 March budget and will instead look at extending furlough and the business rates holiday.

Despite Amazon’s nearly £20bn profit for 2020 it only had a tax turnover ratio of 0.37%, according to real estate adviser Altus Group.

Altus looked at Amazon’s entire UK estate, including offices, warehouses and collection lockers, and found its overall business rates liabilities were estimated to be around £71.5m at the start of the 2020/21 financial year.

High street retailers paid around 2.3% of annual retail sales in business rates before the pandemic, the Centre for Retail Research said.

TechUK, the UK’s technology trade association, told Sky News it had not received a request from Treasury officials for a meeting this month.

“We would, however, welcome the opportunity to discuss the overall risks and benefits of such a tax, the effects on business or the wider customer and economic impacts,” a spokesman said.

“Tech businesses have played a fundamental role in keeping the economy running over the last year and will be essential to future economic growth and recovery.”

Helen Dickenson, chief executive of the British Retail Consortium, said ministers should not prevent businesses’ ability to recover from the pandemic.

“The key to reviving our high streets is fundamental reform of the business rates system and we oppose any new taxes that increase the cost burden on the industry which is already too high,” she said.

“Economic recovery after COVID will be powered by consumer demand – the chancellor should ensure he doesn’t introduce any new taxes that stifle this.”

Amazon said it would not comment on the online sales tax reports.

A spokesman said: “Last year we created 10,000 new jobs and last week we announced 1,000 new apprenticeships.

“This continued investment helped contribute to a total tax contribution of £1.1 billion during 2019 – £293 million in direct taxes and £854 million in indirect taxes.”