Public sector borrowing rose to £19.1bn last month as the cost of tackling the coronavirus pandemic took a further toll.

The sum – which represents the shortfall between the government’s revenues, such as tax, and its spending on things like the NHS – was the highest for February on record.

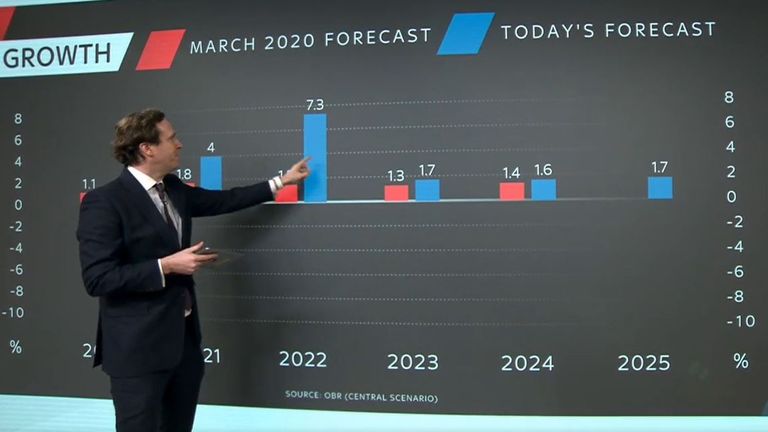

It was a little lower than the £21bn that had been pencilled in by economists and may mean the chancellor undershoots the colossal £355bn total for 2020/21 pencilled in by the Office for Budget Responsibility (OBR), unprecedented since the Second World War.

The outlook for the full year has also been helped by a £5.6bn downward revision for January’s shortfall.

But the scale of the deficit continues to shatter records.

For the 11 months to February, borrowing stood at £278.8bn, compared to £50.6bn a year earlier, the highest for the period since comparable records began in 1993.

That borrowing adds to the overall debt pile, now standing at £2.13trn or 97.5% of GDP – a level of debt as a proportion of national income unseen since the 1960s.

The latest monthly figures, published on Friday by the Office for National Statistics (ONS), showed that the Treasury’s tax take from the battered economy was £1.5bn lighter in February than a year earlier, with revenues from VAT, business rates and fuel duty falling notably.

At the same time, spending by central government bodies was £14.2bn higher, including £3.9bn on job support measures such as the furlough scheme and £2.1bn in other subsidies, mainly to keep transport networks going.

An additional £5.8bn was also spent on procurement and pay, largely reflecting the efforts of the health service and other government bodies to fight the pandemic.

Meanwhile, interest payments on government debt were £1.2bn higher than a year earlier, as inflation – to which government index-linked bonds are pegged – crept up.

Chancellor Rishi Sunak, responding to the data, said his £352bn of total extra spending and tax cuts so far had been the responsible thing to do.

“But I have always said that we should look to return the public finances to a more sustainable path once the economy has recovered and at the budget I set out how we will begin to do just that,” Mr Sunak said in a statement.

The Institute of Fiscal Studies, a respected economic think-tank, has said that spending cuts implied by the budget are “simply unrealistic, and borrowing or taxes will be higher than planned.”

Investec economist Sandra Horsfield said the latest borrowing figures may mean the OBR’s forecast for annual borrowing for the year to the end of March turns out to be overly pessimistic.

But she added: “Even with today’s better-than-expected figures, it remains the case that the hit to the public finances from the pandemic – both in terms of the automatic impact on tax receipts and expenditure, and from discretionary measures taken in response – is enormous.

“The furlough scheme alone is estimated to have cost £74.4bn so far in the current tax year.

“Even since the budget, there have been further pressures to raise government spending, including on NHS pay.”