The FTSE 100 has climbed above the 7,000 mark for the first time since the early days of the coronavirus crisis.

London’s leading share index rose as industrial, banking and mining stocks made gains on growing optimism about economies reopening and recovering across the world.

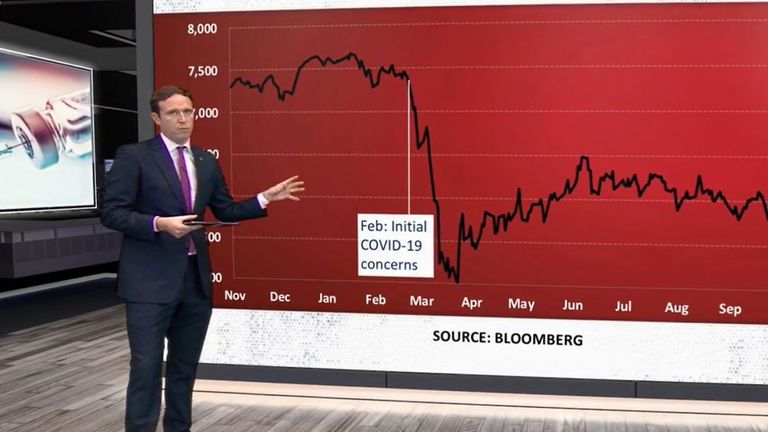

The FTSE 100 was last above the 7,000 mark in February last year before slumping as much of the world was plunged into lockdowns.

It is now about 40% higher than its low point in March 2020 – when it dipped below 5,000 as Britain’s economy went into the deep-freeze from which it is still trying to emerge.

Massive stimulus from central banks and spending support from governments across the globe helped stabilise sentiment with hopes for vaccine rollouts delivering a further boost.

However, the London index’s recovery has lagged that of New York, whose leading stock indices have been trading at record highs for months – helped by Wall Street’s big tech stocks, some of which were big winners during the pandemic.

On Friday, the FTSE 100 finally pushed through the 7,000 barrier as it climbed by about 50 points to more than 7,030.

Russ Mould, investment director at AJ Bell, said: “This represents a massive milestone in recovering from the terrible pandemic and shows how investors’ confidence has completely changed since just over a year ago.

“The market was understandably shocked as the coronavirus gripped the world but in true investor style it has quickly focused on the future and the ability for corporate earnings to recover.”

British Airways owner International Airlines Group led the way, adding close to 3%, while banking stocks Barclays and Natwest were also among the biggest risers on the day.

The mood was boosted by latest positive signs from the US economy this week as well as continued recovery in China – though latest quarterly GDP figures showed a weaker than expected performance.