One of the parties interested in making a counter offer for Morrisons has been granted more time to ‘put-up or shut-up’.

US private equity group Clayton, Dubilier & Rice (CD&R) had made the request for additional time on Friday – ahead of a Takeover Panel deadline for any counter bids to have been submitted.

The supermarket chain’s board had recommended that same day an improved offer worth £6.7bn from Softbank-owned Fortress Investment Group.

It had previously backed a bid from the Fortress-led consortium worth £6.3bn but a number of major Morrisons’ investors, including its largest shareholder Silchester, had indicated they would reject it on value grounds.

The new recommended offer comprises 270p per Morrisons share plus a 2p per share special dividend.

The Fortress bid was submitted ahead of a deadline of 5pm on Monday for CD&R to indicate a formal offer of its own after a proposal worth £5.5bn was rejected by Morrisons in June.

Morrisons applied to the panel for that deadline to be extended and also confirmed it had postponed until 27 August a shareholder vote, originally due this week, on the Fortress terms.

The Takeover Panel, which regulates UK merger and acquisition activity, agreed to give CD&R until 20 August to announce a firm intention to make an offer for Morrisons or walk away – a so-called ‘put-up or shut-up’ order.

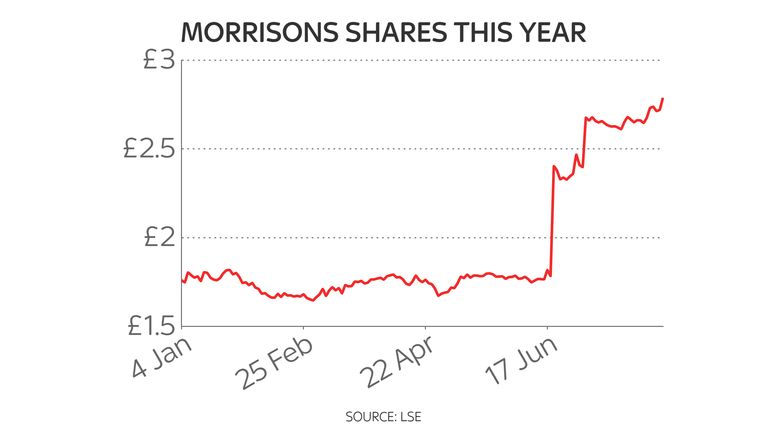

Shares in Morrisons – up almost 60% in the year to date as a result of the bid interest – closed at 278.8p on Friday, indicating investors are hoping for a higher offer.

The stock was trading at 280p in early deals on Monday.