Campaigners have demanded a 25p cut in fuel prices to help reduce the cost of living.

FairFuelUK said fuel duty should be cut by 20 to 25p per litre in a similar manner to cuts seen in Europe.

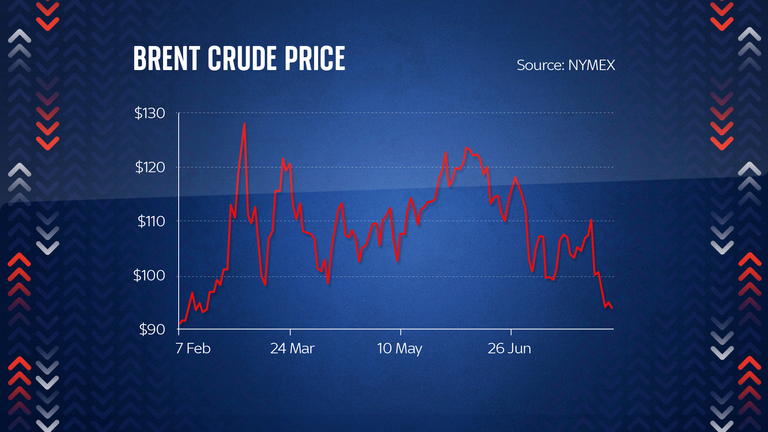

The campaign organisation said the price of a barrel of Brent Oil was now below £80 a barrel and should signal a “considerable” reduction in filling up at the pumps.

It said when the oil price was at £80 a barrel in February pump prices were 31.4p lower for petrol and 38.1p lower for diesel.

The group said the government was “wallowing” in an extra £30m of VAT each day as a result and the average family is paying £15 to £20 more than necessary to fill up now, compared to when oil prices were the same back in February.

It said a cut in fuel duty and an independent PumpWatch would have a “massive positive effect” on reducing inflation and the cost of living.

Howard Cox, founder of the FairFuelUK Campaign said: “The foul stench of profiteering gets even more overpowering.

“Despite the cost of oil falling 14% since 1 June, pump prices remain stubbornly 6 to 7p higher.

“The Tory government, stuck in its self-absorbing overlong leadership contest, is allowing the fuel supply chain to ruthlessly exploit UK’s drivers completely unchecked.

“And the Treasury’s coffers are bulging at the seams with a shed load of extra VAT too. An independent PumpWatch is way overdue and it’s morally repugnant it’s not been up and running by now.”

Robert Halfon MP, vice chair FairFuelUK APPG said: “This is literally highway robbery from the big oil companies.

“We need PumpWatch now, to ensure that motorists have a proper watchdog to investigate what appears to be racketeering.”

It comes as petrol and diesel prices are steadily falling in the UK, according to the latest figures.

The average price for a litre of unleaded petrol last Saturday was 177.46p, according to the RAC, while diesel cost an average of 188.23p.

On Thursday, the prices had been 178.93p and 189.3p respectively.

World oil prices are falling, something analysts have said is due to fears tough economic times ahead could see a weakening of demand.