The government has ruled out a U-turn on the costly tax-cutting mini-budget and the chancellor will not resign despite mounting pressure.

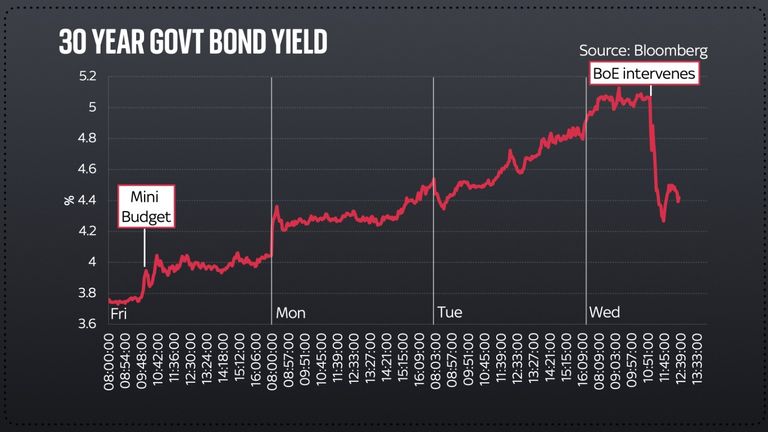

It comes after a day in which the Bank of England was forced to launch a temporary bond-buying programme as it took emergency action to prevent “material risk” to UK financial stability.

Bank’s ‘nearly unthinkable’ intervention – economy latest

Sky’s political editor Beth Rigby was told that the chancellor, Kwasi Kwarteng, would not be resigning and that there would be “no reversal of policy”.

A minister told deputy political editor Sam Coates it was “bulls***t” to say that today’s market movement was related to the mini-budget announcement.

And on The Take with Sophy Ridge, chief secretary to the Treasury Chris Philp denied that the government had any responsibility and said there would be no change of course.

Politics Hub: No mini-budget reversal and chancellor will not resign

The Bank will buy as many long-dated government bonds as needed between now and 14 October in a bid to stabilise financial markets in the wake of the mayhem that followed the government’s mini-budget last Friday.

In addition to the plunge in the value of the pound, it has also seen investors demand a greater rate of return for UK government bonds – essentially IOUs.

That is because the level of borrowing required to fund the government giveaway, including tax cuts and energy aid for households and businesses, shocked the market which immediately questioned the sustainability of the public finances.

City minister Andrew Griffith told Sky’s economics editor Ed Conway: “Every major economy is dealing with exactly the same issues.”

“They [the bank] have made a targeted and timely intervention in the market. That’s their decision, but they’ve done so working very closely with the chancellor.”

The Bank’s action comes after the International Monetary Fund added its voice to criticism of the growth plan.

Read more:

Ed Conway on the Bank’s extraordinary response

Liz Truss is a ‘danger to the economy’, Starmer says

Government departments asked for ‘efficiency savings’

What the Bank’s action is aimed at doing is tackling the consequences of rising bond yields, in this instance a liquidity crunch facing pension funds.

The pound fell back in response but bond yields did ease back from multi-year highs.

The Bank said in a statement: “Were dysfunction in this (long-dated bond) market to continue or worsen, there would be a material risk to UK financial stability.

“This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy.”

‘Significant’ interest rate rise likely ahead

The programme marked the Bank’s first policy intervention as it battles to bring down inflation and ease the cost of living crisis. Its chief economist signalled on Tuesday that a “significant” rise in Bank rate was also likely ahead.

The government’s growth plan is only seen as adding inflationary pressure to the economy, leaving it at loggerheads with the Bank’s mandate.

The Bank said the bond purchases, which would be fully covered by the Treasury in the event of any losses, would be sold back once market conditions had stabilised.

The announcement certainly had an immediate effect on the market.

Data showed that 30-year bond yields fell back to 4.3%, having risen to levels above 5% not seen since 2002 earlier in the day. There were similar falls for 20-year yields.

Those for 10-year bonds also fell back below 4% from 4.6%.

Stock markets, which had endured widespread falls Europe-wide amid recession fears, erased some of their losses.

The FTSE 100 had been almost 2% down but was just 0.8% lower on the day just before 1pm.

The pound, however, was a cent and a half down versus the dollar shortly after the announcement, to stand at $1.0578, and a cent lower against the euro. It later moved back towards $1.07 as market surprise at the intervention eased.

The single European currency was also suffering against a resurgent US currency.

Bank going ‘toe-to-toe’ with the market

The Bank said it would also postpone its efforts to unwind the sale of bonds it acquired through quantitative easing during the financial and COVID crises.

The Bank had planned to reduce its £838bn of gilt holdings by £80bn over the next year.

Neil Wilson, chief markets analyst at Markets.com, said the move followed evidence of “severe liquidity stress”.

This would have been particularly evident for pension funds who have faced demands for additional cash to cover off rising yields.

“We’re now seeing the Bank go toe-to-toe with the market and this might not lead to any decrease in volatility.”