The chancellor stuck to his path. No big bangs, this was a budget all about trying to prepare the groundwork for possible tax cuts in the autumn statement and the pre-election showstopper next year.

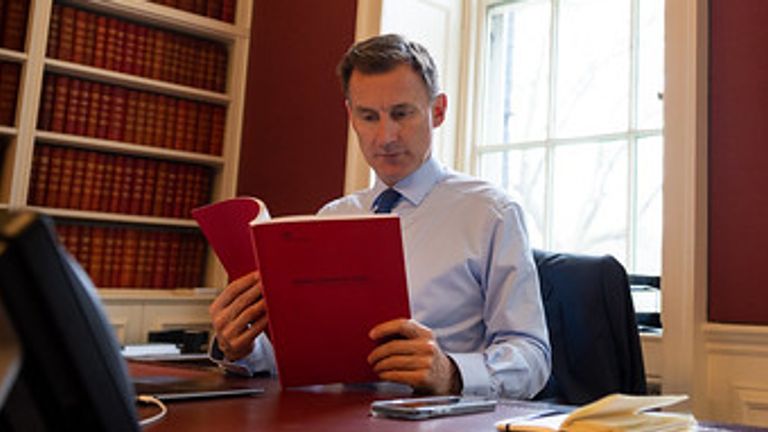

Jeremy Hunt’s message was that after the mess of the past six months, the Conservative Party was back to sound management of the economy.

He lauded the Office for Budget Responsibility’s forecast that the UK will avoid a technical recession (defined by two consecutive quarters of negative growth) in 2023: “We are following the plan and the plan is working.”

In a nod to the shocker that was Liz Truss’s mini (mega?) budget last September, there were no sudden moves or big surprises from Mr Hunt as he executed targeted measures to try to grow the economy.

At the heart of it were packages for business and investment and a programme to get parents, the over 50s, the sick and the disabled back into work.

£9 billion of business tax breaks to encourage companies to invest, a £5bn extension of free childcare in England, and tax breaks for those with the biggest pension pots are the most eye-catching policies to achieve that goal.

Steady and sensible, it was if you like a “technical” budget making some targeted changes designed to achieve the chancellor’s aims and build that narrow pathway the Conservatives believe could lead them back into Number 10 at the next general election.

The aim: a government seen as competent, an economy ticking up, the conditions created to win over voters through bigger giveaways. But there is plenty of room for blow ups in this budget too.

As the chancellor hailed his extension of the energy price guarantee for three months, the freeze in fuel duty, the childcare plans; the OBR – the fiscal watchdog – was putting out forecasts reminding us of the reality, with living standards expected to fall over 6% over the next two years.

While that is not quite as bad as the forecast from last November, it still represents the biggest two-year drop in living standards since the 1950s.

And these targeted measures are a drop in the ocean when it comes to the fiscal drag caused by freezing tax bands, with the OBR predicting that nearly six million people will be dragged into higher tax bands over the next four years, raising £29.3bn for the government in 2027-8 – equivalent to a 4p increase in the basic rate of income tax.

You can see why Conservative backbenchers are clamouring for tax cuts as they eye a country under Tory rule for 13 years that is now shouldering the biggest tax burden since the Second World War.

Set that against the shock policy of the day, the decision to scrap the £1m lifetime allowance cap on pensions, and you can see where the chancellor could politically come under fire.

His decision to scrap the lifetime allowance while also lifting the annual allowance from £40,000 to £60,000 will cost about £1.1bn a year and benefit rich people who now have no limit to how much money they put into their pension pots.

Only 8,600 people breached the £1m lifetime allowance in 2020-2021, and they are certainly not the group in society most in need of a tax break.

The government argues that this a policy designed to get over 50s professionals – particularly doctors and medics – into work.

But big spending measures, benefitting only the 1% in society with giant pension pots, at a time of a cost of living squeeze, has all the hallmarks of a potential budget blow up.

Just cast your mind back to Liz Truss’s £2bn plan to scrap the 45p top rate of tax last September. That did not last long.

But all of it has to be seen in the context of the only shot the Conservatives think they’ve got to snatch a victory off Labour in the 2024 general election.

They want to show the public they can manage the economy, return it to growth and then ask voters to stick with a government beginning to get it right when they go to the polls, probably at the back end of 2024.

The million dollar question is can they pull it off?

Paul Johnson of the IFS told me it’s pretty touch and go, with a tough summer ahead followed by growth at the back end of the year and real incomes “moving in the right direction in a year’s time”.

“There will be an opportunity to chuck a little bit more money at some people in the autumn statement and budget next year,” Mr Johnson told me.

“So it depends to some extent whether people think ‘we’re now on the right path, we’re at least moving in the right direction even if from a rather low point’ or whether they’re thinking ‘we’re still actually worse off than we were three or four years ago, so we don’t feel very good about that.”

Read more:

Jeremy Hunt’s challenge is whether voters will feel the benefits fast enough

Budget Q&A: When do pension and childcare changes start?

It is a tight timeframe to turn things around, with household incomes probably still where there were pre-pandemic and people feeling stretched.

Furthermore, the chancellor is barely meeting his own fiscal rule of debate falling as a share of national income in five years’ time – with the headroom for hitting that target falling from £9bn in November to £6.5bn now.

All of that makes it harder to conjure up a big pre-election splurge.

Despite all of that, this is the only plan Mr Sunak’s got, and the chancellor was at least able to tell the public that the PM’s promises to get the economy growing again this year and halve inflation would be met.

Recession averted, but households up and down the land are still facing the worst two years for real household disposable incomes in modern times.

Mr Hunt insisted on Wednesday the “British economy was proving the doubters wrong”.

But he’s still some way from turning a disillusioned electorate into believers once more.