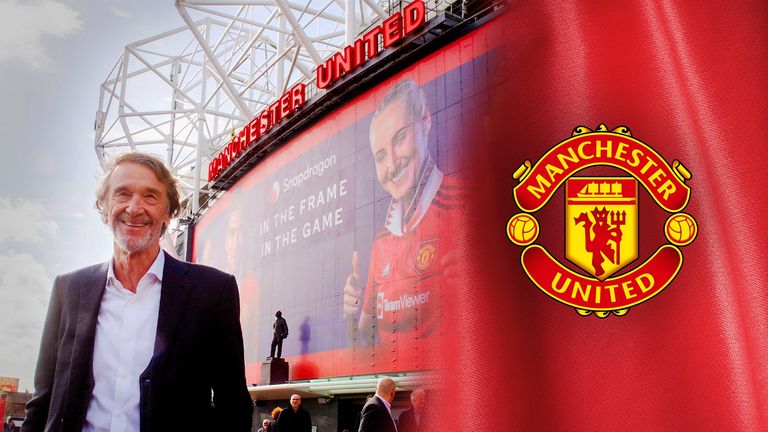

The chief executive of Manchester United Football Club is to leave after just two years in the job as its owners finalise the sale of a minority stake to the petrochemicals billionaire Sir Jim Ratcliffe.

Sky News has learnt that the Old Trafford club will announce to the New York Stock Exchange later on Wednesday that Richard Arnold is to step down by the end of the year.

He will hand over operational control of the club immediately and will be replaced as interim CEO by Patrick Stewart, who will also retain his role as general counsel.

The shake-up in United’s leadership will come just days before the club is expected to confirm Sky News’ exclusive revelations that Sir Jim’s Ineos Sports is acquiring a 25% stake.

Mr Arnold has been with the Red Devils since 2007, replacing Ed Woodward in the top executive job early last year.

Insiders said he had succeeded in modernising the structure of United’s football operations, even as the men’s first team struggles in domestic and European competitions under manager Erik Ten Hag.

Under Mr Arnold, United won its first trophy in six years by beating Newcastle United to win the Carabao Cup, and delivered industry-leading commercial deals with Adidas and Qualcomm.

The last year has, however, been one of turbulence amid ongoing uncertainty about the club’s future ownership.

A strategic review was initiated by the Glazer family almost a year ago, although it is expected to be resolved next week with confirmation of Sir Jim’s arrival.

Mr Stewart has been at United for 17 years, and already leads its liaison with governing and representative bodies including the Premier League and UEFA.

One source said his appointment as interim CEO would allow United’s new joint owners to identify the right long-term candidate to run the club.

Sky News revealed earlier this month that Sir Jim is to commit $300m (£245m) from his multibillion pound fortune to overhauling United’s ageing infrastructure, in addition to the roughly £1.3bn he will spend on acquiring a 25% stake.

The funds will be financed by Sir Jim personally and will not add to Manchester United’s existing borrowings.

Reports in recent weeks have suggested that the billionaire will take immediate control of football matters at the club, alongside Ineos Sports colleagues including Sir Dave Brailsford, the former cycling supremo.

Many United fans have expressed disquiet at the prospect of Sir Jim buying a minority stake given that it paves the way for the Glazers’ continued control.

The family, who paid just under £800m to buy the club in 2005, has remained inscrutable throughout the process and has said nothing of substance to the NYSE since the process of engaging with prospective buyers kicked off.

Earlier iterations of Sir Jim’s offers for the club, which focused on gaining outright control, included put-and-call arrangements that would become exercisable three years after a takeover to enable him to buy out the remainder of the club’s shares.

The Monaco-based billionaire, who owns the Ligue 1 side Nice, pitched a restructured deal last month in an attempt to unblock the ongoing impasse over United’s future.

In addition to the competing bids from Sir Jim and Sheikh Jassim, the Glazers received several credible offers for minority stakes or financing to fund investment in the club.

These include an offer from the giant American financial investor Carlyle; Elliott Management, the American hedge fund which until recently owned AC Milan; Ares Management Corporation, a US-based alternative investment group; and Sixth Street, which recently bought a 25% stake in the long-term La Liga broadcasting rights to FC Barcelona.

Part of the Glazers’ justification for attaching such a huge valuation to the club resides in the possibility of it gaining greater control in future of its lucrative broadcast rights, alongside a belief that arguably the world’s most famous sports brand can be commercially exploited more effectively.

United’s New York-listed shares have gyrated wildly in recent months as reports have suggested that either a deal is close or that the Glazers were about to formally cancel the sale process.

The Glazers’ tenure has been dogged by controversy and protests, with the absence of a Premier League title since Sir Alex Ferguson’s retirement as manager in 2013 fuelling fans’ anger at the debt-fuelled nature of their takeover.

Fury at its proposed participation in the ill-fated European Super League project in 2021 crystallised supporters’ desire for new owners to replace the Glazers.

Confirming the launch of the strategic review last November, Avram and Joel Glazer said: “The strength of Manchester United rests on the passion and loyalty of our global community of 1.1bn fans and followers.

“We will evaluate all options to ensure that we best serve our fans and that Manchester United maximizes the significant growth opportunities available to the club today and in the future.”

The Glazers listed a minority stake in the company in New York in 2012.

“Love United, Hate Glazers” has become a familiar refrain during their tenure, with supporters critical of a perceived lack of investment in the club, even as the owners have reaped large dividends as a result of its ability to generate sizeable profits.

Manchester United declined to comment on Mr Arnold’s departure.