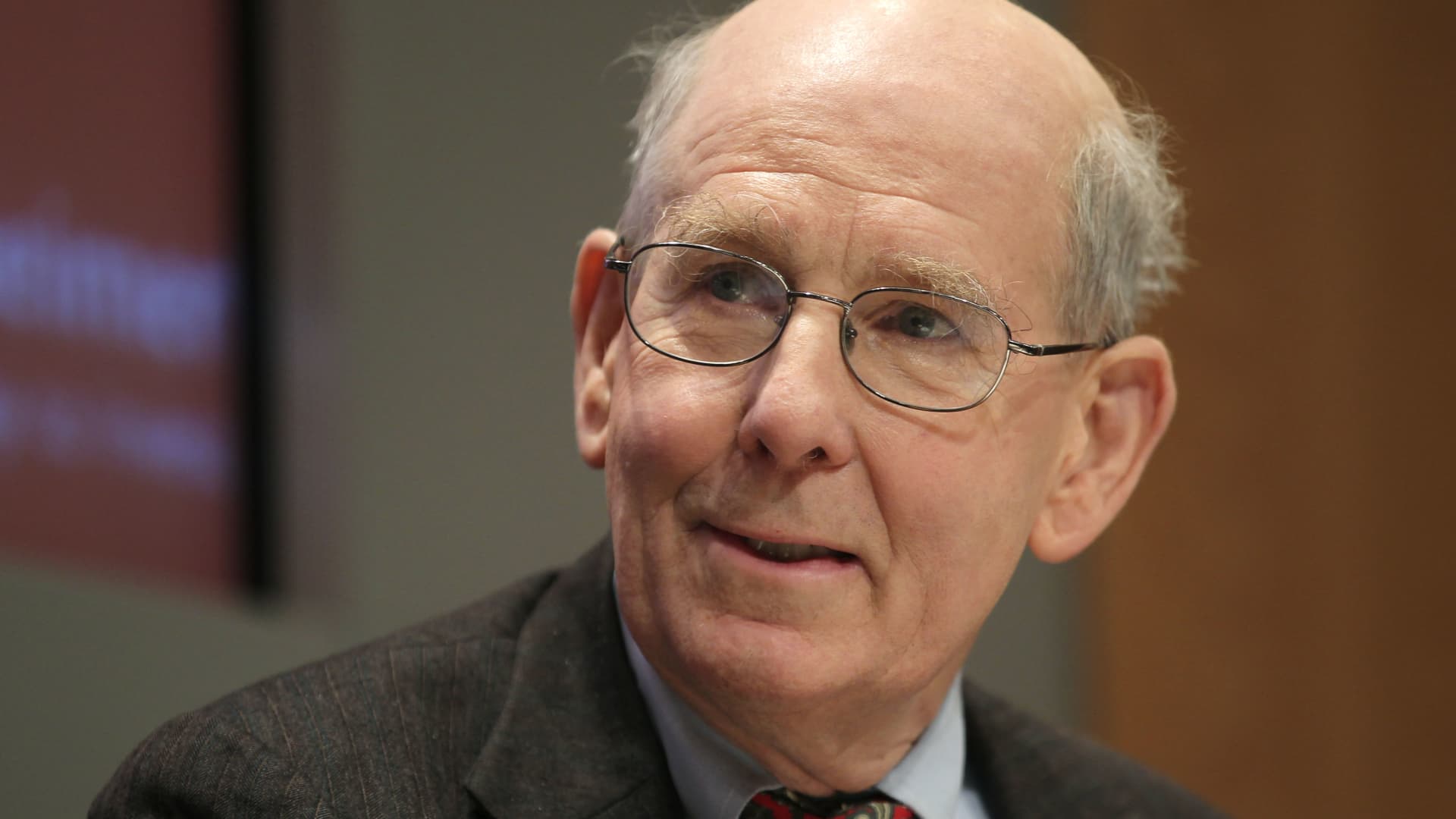

The U.S. economy has avoided a recession so far but the risk of a deeper economic downturn still looms, according to financial analyst Gary Shilling.

Take U.S. small businesses as one of the “normal harbingers of recessions, [such as] the yield curve, the leading indicators,” Shilling said.

“Small businesses are very sensitive to economic conditions because they don’t tend to be very heavily capitalized,” Shilling told CNBC. “They are cutting back on their employment and other areas.”

However, the labor market at large is a key reason the U.S. has thus far avoided a recession.

“We’ve had more strength in employment than probably is commensurate with the state of business,” Shilling said.

During the labor shortage, businesses that were hiring had to compete for workers.

Now, those companies are reluctant to lay off staff after spending so much time and energy to hire new employees, which Shilling believes has kept the labor market stronger than expected.

“You haven’t had that weakness in labor markets that, I think, you normally would have had and would have [caused] a recession [in 2023],” Shilling said. “That doesn’t mean we won’t have one, but it means whatever it is, it’s delayed.”

However, Shilling is watching for signs of a slowing labor market.

“There are a lot of preliminary signs of weakness in the labor market,” he said, pointing to wage gains, quits and service inflation.

“It’s the service inflation [that] really is a difficulty for the Fed, and if you look at wages in the service area, they’re rising 5% or 6% year over year,” Shilling said. “Now that’s hardly commensurate with the Fed’s target of 2% inflation.”

The Federal Reserve has indicated that it plans to cut interest rates at least three times in 2024.

“The Fed is going to reduce interest rates, but they want to make sure that inflation is killed and killed dead because I think the Fed is in no rush. And why should they be,” Shilling said. “There’s no clear evidence that the economy is falling apart. As long as the employment is as strong as it is, the Fed is in no rush to cut interest rates.”

Watch the video above to learn more about what may be next for the U.S. economy, from key indicators and artificial intelligence to globalization and the next presidential election.