US financial market regulators are to review the extraordinary rallies in the shares of struggling gaming retailer Gamestop, part-driven by participants of an investor forum on Reddit.

The Securities and Exchange Commission said it was working with fellow regulators to “assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants”.

The action reflects deep and widespread concern over the functioning of financial markets.

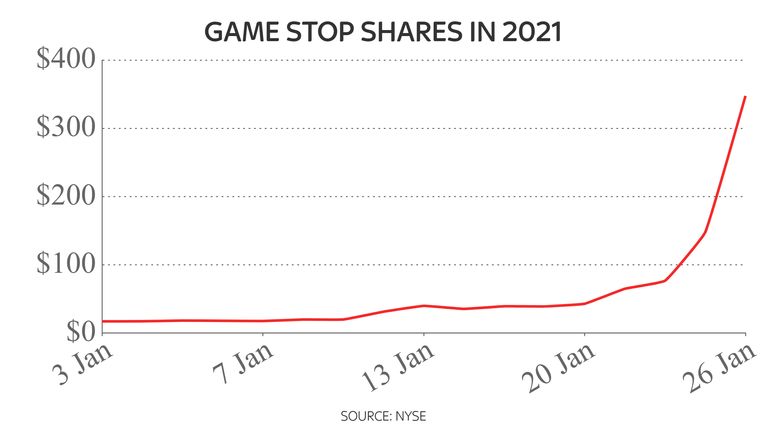

Gamestop shares were up by 1,744% in the year to date – with a market value above $20bn – at the close of trading on Wednesday night.

The value boom of the past week has created more than $2bn in personal wealth for its three largest individual shareholders, whose holdings have not increased during the frenzy.

The staggering leap represents a victory for retail investors over hedge fund short-sellers, who are nursing heavy losses, as markets witness a boom in amateur stock trading.

Millions of Americans have taken advantage of zero-commission trading platforms during the coronavirus crisis – often using social media forums to discuss opportunities.

The value surge has not been restricted to Gamestop.

Its shares, and those of other firms including BlackBerry and AMC Entertainment, fell by more than 20% in extended trading when it emerged that Reddit had temporarily closed the Wallstreetbets chat room.

The volatility prompted widespread calls for scrutiny of trading fuelled by anonymous social media posts. Reddit said it had not been contacted by any authorities in relation to users’ behaviour.

The phenomenon has not been restricted to the US, with some heavily-shorted UK stocks including Cineworld also showing signs of retail activist-style gains. Sky News has approached the Financial Conduct Authority for a response.

Wider US market falls in recent days have been blamed on hedge funds selling positions to pay for losses shorting Gamestop.

Wednesday’s session saw the main indexes on Wall St lose more than 2% and futures indicate further turbulence ahead.

Even the new US treasury secretary, Janet Yellen, said she was “monitoring the situation” while a state regulator has called for Gamestop shares to be suspended for 30 days to allow a cooling off period.

Technology investor Chamath Palihapitiya told Sky’s sister channel CNBC: “We are moving to a world where ordinary folk have the same access as professionals and can come to the same conclusion or maybe the opposite.

“The solution is more transparency on the institutional side, not less access for retail.”

In Gamestop’s case, it has been shuttering stores for years in a tough retail landscape and market analysts have likened the stock interest – driven purely by retail investors – to a pyramid scheme.

Nasdaq chief Adena Friedman said: “If we see a significant rise in the chatter on social media … and we also match that up against unusual trading activity, we will potentially halt that stock to allow ourselves to investigate the situation.”