There is growing evidence the economy is finding a new gear following more than a year of coronavirus disruption, with two readings of activity showing record rates of growth for this century.

First, data from the Bank of England showed the biggest net increase in mortgage lending on record during March – driven by tax breaks including a stamp duty holiday for England and Northern Ireland that was extended at the budget.

A closely-watched reading of health in the manufacturing sector showed growth hit speeds not seen since 1994 in April.

The Bank revealed that mortgage borrowing rose by a net £11.8bn – the strongest increase since records began in 1993.

It said that lenders approved 82,735 mortgages in March, down by about 5,000 from February as activity surged in anticipation of an easing in COVID-19 lockdowns, low interest rates and further opportunities for tax savings.

Buyers have been scrambling for properties with outdoor space since last summer, with separate data showing prices rising at levels not seen for more than six years even before Chancellor Rishi Sunak pushed back the date for the conclusion of the stamp duty holiday, which will be tapered from the end of June.

Nationwide reported just last week that asking prices rose at the fastest monthly rate since 2004 in April.

While residential property is enjoying a boom time, the latest data covering manufacturing showed an 11th consecutive month of growth.

The IHS Markit/CIPS Purchasing Managers’ Index (PMI) came in at 60.9 in April following a reading of 58.9 the previous month.

Anything above 50 is seen as a sector in growth.

The survey credited output growth due to the loosening of lockdown restrictions, improved demand and rising backlogs of work.

It added to a similar PMI snapshot covering the powerhouse services sector, with final figures due later in the week.

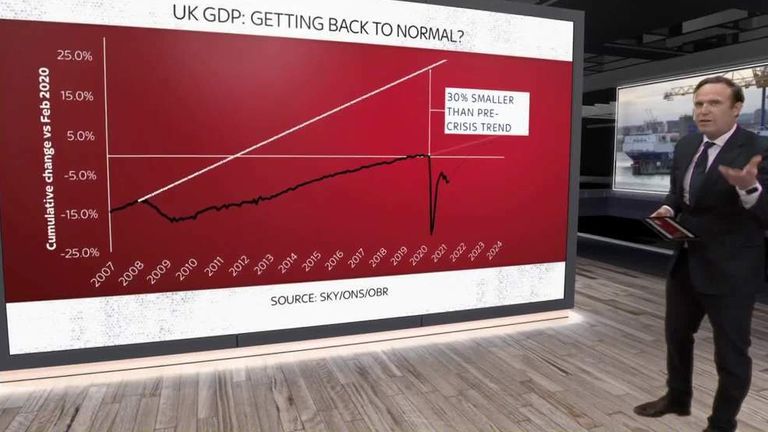

The UK economy is tipped to report a slight contraction in the first quarter of the year as the effects of the latest lockdowns are felt following the worst annual contraction for more than 300 years in 2020.

Economists largely expect a bounceback over the rest of the year, with the Office for Budget Responsibility forecasting growth of 4%.

But Rob Dobson, director at IHS Markit which compiles the PMI survey, said that while the outlook was brighter there were headwinds for manufacturing growth with implications for inflation ahead.

He wrote: “The sector also remains beset by supply-chain issues and rising inflationary pressures.

“Disruption following Brexit and COVID-19, especially at ports, caused a further near-record lengthening of supplier delivery times.

“The resulting input shortages kept producer price inflation among the highest over the past four years.

“Manufacturers have generally passed on these costs to customers, as highlighted by a survey-record rise in selling prices, but it is hoped that this inflationary backdrop will subside once supply and demand come back into line as

Covid-related logistic delays ease.”