It may have been billed a mini-budget, but what Kwasi Kwarteng announced on Friday was massive.

A package of tax cuts on a scale not seen for half a century, paid for through borrowing at increasingly expensive rates in the hope that it will deliver better growth.

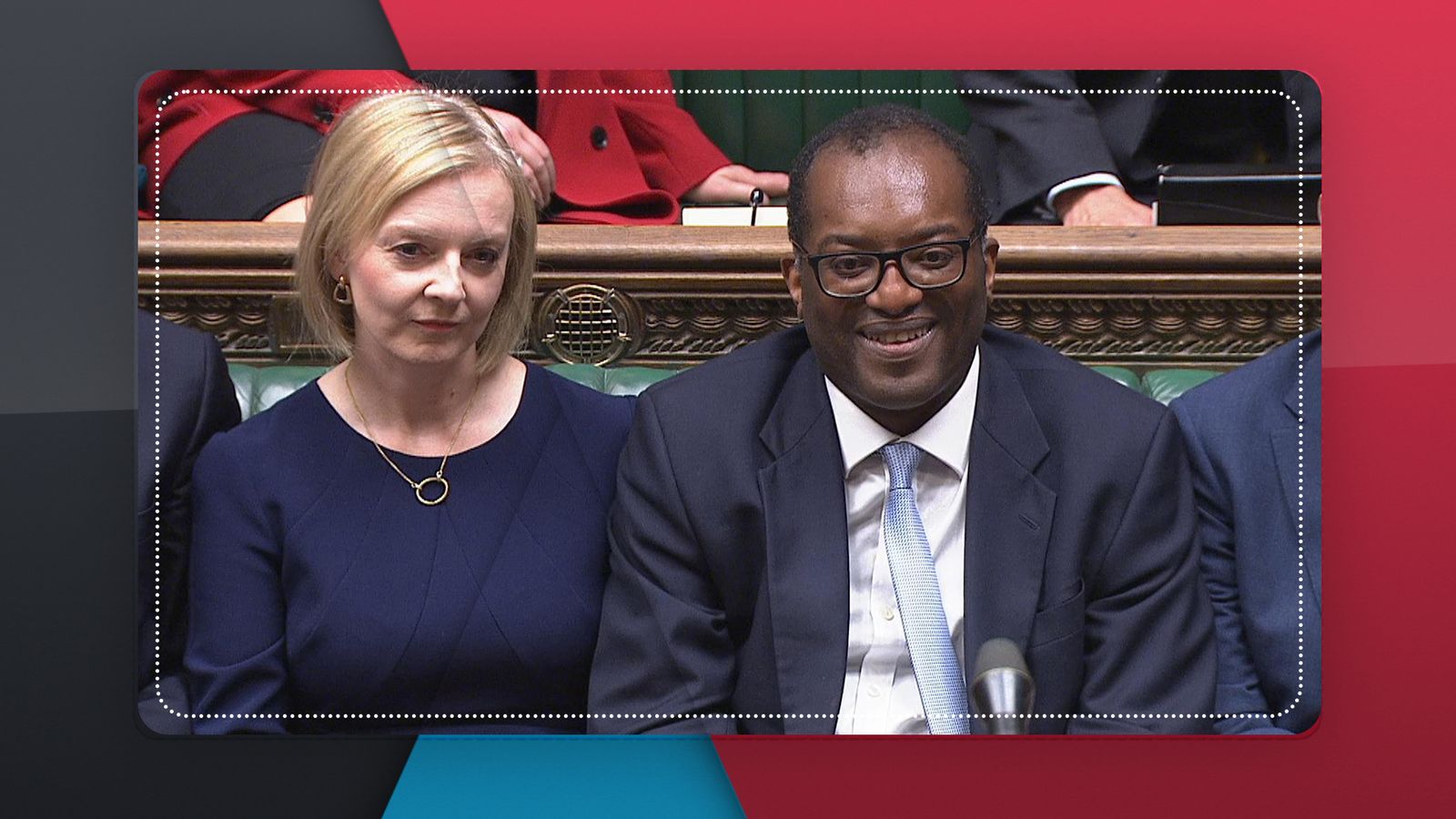

This is an administration that promised “shock and awe” – as one of the key figures put it to me – when they entered government three weeks ago. And on that, Liz Truss and her chancellor are delivering.

“A new approach for a new era, focused on growth,” is how Mr Kwarteng described the approach.

But “madness” is how one of the chancellor’s colleagues characterised it. “I’m scared. I think they might tank the economy,” they told me.

Audacious or reckless, depending on your view, what those who back Ms Truss and those who don’t can agree on is it’s a huge roll of the dice.

“Go big or go home” seems to be the mantra of this new administration, and on Friday Mr Kwarteng – and I quote here Paul Johnson of the Institute of Fiscal Studies – decided not just to gamble on a new economic strategy, but bet the entire house.

But the Kwarteng camp is clear-eyed in the aims. “We have no other options,” is how one senior figure put it to me on Friday. “We have to grow the economy, because economic growth pays for everything.”

To that end, the Truss administration announced a radical plan for tax cuts – £45bn announced on Friday – paid for through borrowing, which jumped £72bn as the deficit was revised upwards from £161.7bn in April 2022 to £234bn in September.

Tax cuts and economic growth, two principles of Conservative economic policy, but what the chancellor appeared to do was to throw the party’s reputation for fiscal responsibility out of the window in the pursuit of growth above all else.

This was a chancellor announcing the biggest tax cuts since 1972 without an independent assessment of the impact of the plans from the Office of Budget Responsibility, and without any wider fiscal framework to reassure the markets about the sustainability of the public finances.

The government’s fiscal rules had stipulated that debt should be falling as a share of gross domestic product (GDP) within three years.

On Friday, the chancellor said only he would publish a medium-term fiscal plan in due course – which would include a plan on how to reduce debt as a percentage of GDP.

And how the markets digested the news reflects just how big a gamble it is.

For while, according to the National Institute of Economic and Social Research, the borrowing and tax cuts would trigger growth and lift the UK back out of recession in the short-term, the sting in the tail will be an expected interest rate rise of 5% in order to keep inflation under control.

Meanwhile, the UK’s public debt burden looks set to rise, with the Institute for Fiscal Studies forecasting that public borrowing would top £190bn this year, the third-highest peak since the Second World War, and remain well over £100bn even once the energy support package is withdrawn.

And the markets are reacting. Sterling fell as much as 3% against the dollar to $1.09 – a 37-year low, while the cost of government borrowing rose too as investors sold off UK government bonds.

“I worked on some 60 fiscal events over 31 years,” tweeted Nick McPherson, former permanent secretary at the Treasury, “I can’t remember any generating as strong a market reaction as today’s.”

The political risk is that the new Conservative government is gambling with the reputation for fiscal responsibility and economic competence that it has built over generations – an “existential threat” to the Conservative Party is how one Whitehall source put it to me.

There is also huge risk in tax-cutting policy geared towards the wealthiest in society and big business.

Read more:

Stamp duty, energy bills and alcohol duty: The key mini-budget announcements

Truss admits her tax cuts will disproportionately benefit the rich

Who is Kwasi Kwarteng?

The reversal of a planned corporation tax rise saves big businesses £19bn. The scrapping of the top income tax rate of 45p saves the top 1% of earners (those who earning over £150,000) on average £10,000.

Labour will hope this sows the seeds of defeat for the Conservatives with the opposition able to argue that the Tory party is on the side of the rich rather than working people.

On the other hand, the cuts to a planned national insurance rise, cuts to stamp duty and bringing forward a 1p cut in the basic rate of income tax to 19p next April, might afford Ms Truss a short-term poll bounce from all the tax cuts.

Click to subscribe to the Sky News Daily wherever you get your podcasts

But one senior Labour source tells me that the Tories are misjudging the public mood by throwing down the tax-cutting gauntlet.

“This really is a dividing line,” says the Labour figure. “The Tories think they can campaign on the old-fashioned ‘we’re tax cutters’ and Labour will put up your taxes, but things are in a different place now with the cost of living crisis, people want to know whose side are you on.

“And in focus groups, people think it’s just bizarre not to tax the energy companies on excess profits or lift caps on bankers. The ‘whose side are you on’ argument is being felt much more acutely than ever.”

Three weeks in, and Ms Truss has rolled the die. Now her administration will have to wait to see if the gamble pays off.

Her hope is that economic growth will eclipse the grumbles over fairness and answer the markets’ fears over the health of the British economy. A PM going for broke in the hope she wins big.