Sir Keir Starmer paid £67,033 to HMRC in the last financial year, his tax returns show.

The Labour leader published the details after Rishi Sunak released his on Wednesday, following months of political pressure.

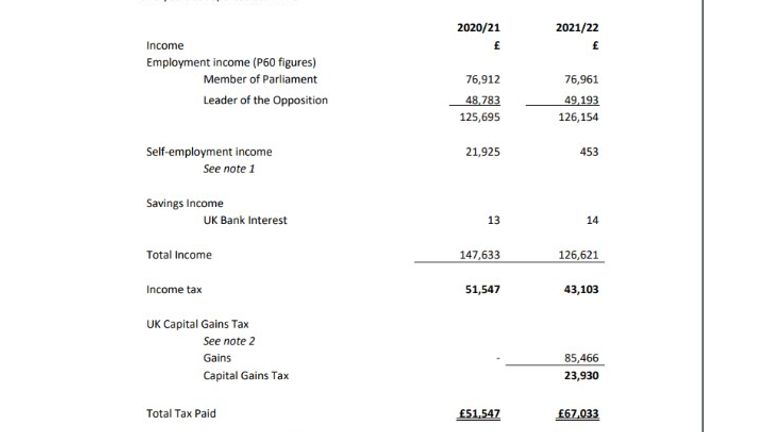

Sir Keir’s document shows he paid £67,033 in total tax for the 2021/22 financial year, and £51,547 the previous year.

It revealed that he made capital gains of £85,466 in the financial year 2021/22, on which he paid £23,930 in capital gains tax.

Notes made in the return said the capital gains tax reflected his share of the capital gains when his sister decided to sell a house he had bought her.

As leader of the opposition Sir Keir took home £126,154 in the same year.

Prime Minister Rishi Sunak said on Wednesday that he was “glad” to publish his financial affairs, which showed he paid £432,493 in tax in 2021/22.

That included £325,826 in capital gains tax and £120,604 in UK income tax on a total of £1.9m in the last tax year, the documents showed.

Sir Keir welcomed the move by Mr Sunak and pledged to publish his own.

He would not comment on the contents of Mr Sunak’s, saying it is for “others to analyse”.

Mr Sunak said he had published his tax returns “in the interests of transparency, as I said I would, and I’m glad to have done that”, adding he did not think the public was that interested.

The publication of the Labour leader’s tax return comes after it was reported that he enjoyed a special “tax-unregistered” pension scheme meaning that the lifetime allowance did not apply to his contributions as Director of Public Prosecutions (DPP) between 2008 and 2013.

Shadow Justice Secretary Steve Reed rejected allegations that Mr Starmer was a hypocrite, telling Sky News: “It wasn’t Keir Starmer as Director of Public Prosecutions who set his own pension.

“That was set by the Conservative government at the time so if people have problems with it they really need to speak to David Cameron and George Osborne,” he said.

A key part of Jeremy Hunt’s budget last week was his decision to abolish the lifetime allowance on pension savings, meaning people will now be allowed to put aside as much as they can in their private scheme without being taxed. The threshold had been £1m.

The Labour Party has pledged to reverse the plans if it wins power, calling it “a Tory tax cut for the rich”.

The party released analysis saying the policy proposed in Mr Hunt’s budget will save the wealthiest 1% of pensioners £45,000 when they retire.

Shadow chancellor Rachel Reeves told Sky News it was “the wrong priority” amid the ongoing cost of living crisis.