High levels of national debt will hurt the UK’s ability to fund public services and respond to economic crises, a think tank has said.

Not in the last 300 years has there been as large a peace time increase in the amount of government borrowing, the Resolution Foundation said.

In the last 15 years alone there’s been a trebling of the ratio of debt to a measure of economic output, called gross domestic product (GDP), the foundation’s Built to Last report said.

Since 2007 the UK’s debt-to-GDP ratio grew from 36% to 100% of GDP in May this year.

The knock-on effect is difficulty in funding services and increasing spending in the event of potential future economic crises, the report said.

And the debt ratio will rise further, according to the report authors.

They forecast it will reach roughly 140% of GDP over the next 50 years if current market expectations are correct – that the UK continues to have high interest rates in the longer term.

Present market expectations, according to market data provider Refinitiv, are that the Bank of England’s base rate will remain above 5% to the end of December 2024.

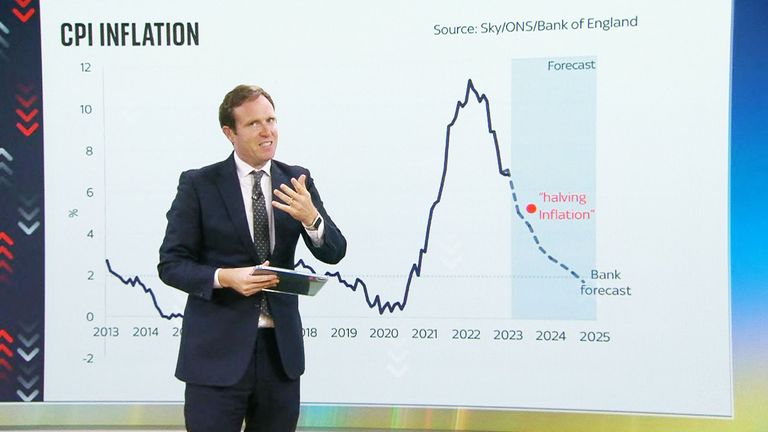

The central bank has brought up interest rates to 5.25%, making borrowing more expensive and saving more rewarding, in an effort to take money out of the economy in an effort to reduce spending and bring down inflation.

Inflation, the rate of price rises, has remained stubbornly high after COVID-19 era supply chain problems pushed up costs, and was significantly worsened by the energy price highs seen after Russia’s invasion of Ukraine.

Each percentage point rise in the base interest rate is adding around £15bn to government borrowing costs in five years’ time as the amount owed on that debt goes up, the report said.

That cost could therefore rise to roughly 5% of GDP – the highest for more than 70 years, it added.

Reducing state debt has political significance as Prime Minister Rishi Sunak has made it one of his five priorities to bring down borrowing.

The report contains criticism of government spending and calls for new a monetary policy for the Bank of England.

Specifically, two forms of state support were poorly targeted, the report said; the “generous” grants to self-employed workers who did not report income falls in the COVID-19 years and the universal nature of household energy supports – such as the energy price guarantee – given to customers up to the end of June to deal with energy bills.

Had the schemes been targeted to those who needed financial help, their overall cost could have been reduced by £35bn, the Resolution Foundation said.

Monetary policy should be changed with the target rate of inflation brought up from 2% to 3%, the report added, but this should only be done when interest rates are low again and when the rate of inflation has reached the current 2% goal.