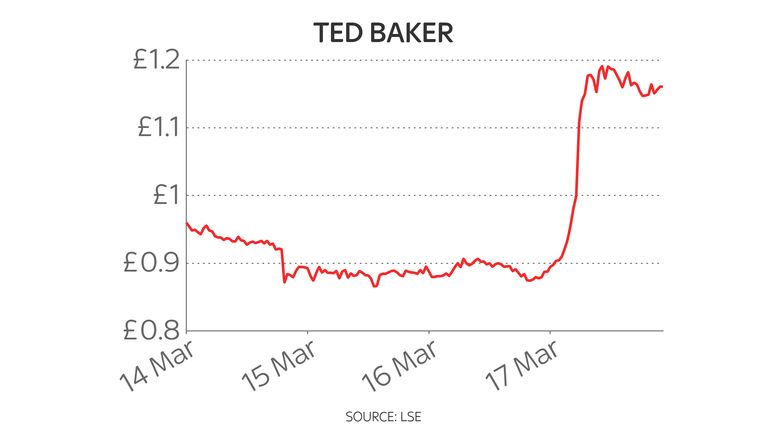

Shares in Ted Baker have surged by as much as a fifth after a US private equity firm confirmed that it was considering a bid for the fashion chain.

Sky News first revealed on Thursday that Sycamore Partners was working with advisers to examine a potential offer for the London-listed company.

Ted Baker, which had a market capitalisation of just over £180m before trading opened on Friday, has seen its shares slide by 95% over the past four years.

The stock climbed by as much as 21% after Sycamore confirmed its interest.

In a statement, the New York based firm said: “The company confirms that it is in the early stages of considering making a possible cash offer for Ted Baker.

“There can be no certainty that an offer will ultimately be made nor as to the terms on which any offer may be made.”

Under UK takeover rules, Sycamore must now confirm whether it plans to make a firm offer or walk away by 5pm on 15 April.

Ted Baker said it had not received any approach from the US company.

It added: “The board is confident in the company’s independent prospects and would evaluate any offer for the company against the strong shareholder value creation that it believes can be delivered as a standalone company.”

Ted Baker has endured a torrid period in recent years, especially in 2019 when founder Ray Kelvin left amid claims of inappropriate behaviour towards female colleagues.

Since then it has been hit by profit warnings, accounting mishaps and was forced to address the COVID-19 pandemic from a position of relative financial weakness.

In 2020, it axed hundreds of jobs and raised £100m to shore up its balance sheet.

Like other fashion retailers, it is now wrestling with the challenges posed by soaring inflation, higher energy costs and waning consumer confidence.

Nevertheless, the business has begun to show signs of a recovery, with a recent trading update disclosing that sales rose by 35% during the 12 weeks to January 29 compared with the same period a year earlier.