Ed Richards, the former boss of media regulator Ofcom, is acting as a secret lobbyist for RedBird IMI, the Abu Dhabi-backed media vehicle which is in advanced talks to take control of The Daily Telegraph.

Sky News has learnt that Flint Global, the public affairs firm founded by Mr Richards, is advising RedBird IMI on its interest in the Telegraph newspapers and Spectator magazine.

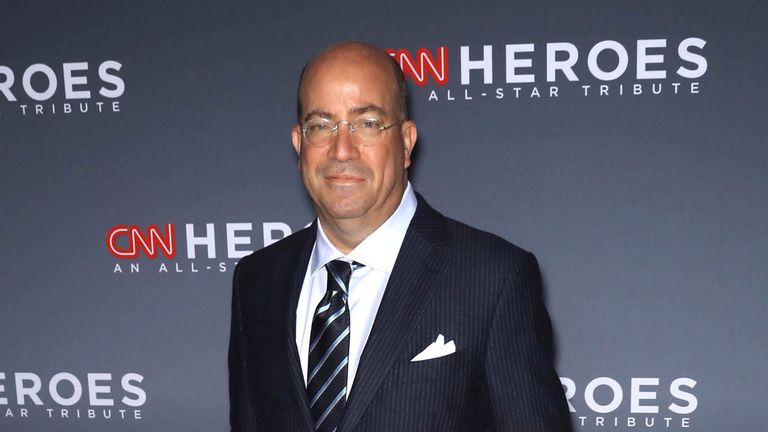

RedBird IMI, which is headed by the ex-CNN president Jeff Zucker, confirmed on Monday Sky News’ exclusive revelation from last week that it is backing the Barclay family’s efforts to thwart a wider auction of the titles.

City sources said that Flint Global had been hired because of Mr Richards’ track record of involvement in public interest intervention notices (PIINs) – government probes carried out by the media and competition watchdogs which can lead to deals being blocked.

In recent weeks, calls to block majority foreign ownership of the Telegraph have gathered pace as MPs and peers – predominantly from the Conservative Party – have raised concerns about Gulf funding of the newspapers.

Neil O’Brien, the MP for Harborough, said on Friday: “The Telegraph and Spectator are two of our most prestigious publications.

“Naturally there’s interest from around the world in gaining control of them.

“I hope [the government] will scrutinise the financing and ownership structure of any deal closely and put them through the usual PIIN process.”

A court hearing to liquidate a Barclay family holding companies in order to smooth a sale of The Daily Telegraph was adjourned on Monday following an offer to repay in full more than £1.1bn to Lloyds Banking Group.

The family hopes to deliver a full repayment of the debt by the end of the month.

The adjourned court hearing would be expected to take place shortly after that date if the Barclays fail in that objective.

Initial offers for the Telegraph and Spectator are due on 28 November, with the billionaire hedge fund tycoon Sir Paul Marshall and Daily Mail proprietor Lord Rothermere among the prospective bidders.

However, the emergence of a potentially imminent deal between the Barclays and Lloyds threatens to derail the auction, according to multiple sources.

RedBird IMI said on Monday that it would convert the £600m of loans to the family into equity “at an early opportunity”.

That statement appears to undermine the Barclays’ earlier claim that its financing partners would merely be providing debt funding, and that there was therefore no justification for ministers to issue a PIIN.

“Under the terms of this agreement, RedBird IMI has an option to convert the loan secured against the Telegraph and Spectator into equity, and intends to exercise this option at an early opportunity,” it said.

“Any transfer of ownership will of course be subject to regulatory review, and we will continue to cooperate fully with the government and the regulator.”

RedBird IMI plans to lend approximately £600m to the family, with the balance of the debt being funded by a member of the Abu Dhabi royal family – said to be Sheikh Mansour bin Zayed Al Nahyan – the ultimate owner of a controlling stake in Manchester City Football Club.

The debt repayment nevertheless remains subject to due diligence by Mr Zucker’s vehicle.

The Barclays have made a series of increased offers in recent months to head off an auction, raising its proposal last month to £1bn.

Lloyds, however, has repeatedly told the family and its advisers that they should either repay the debt in full or participate in the auction alongside other bidders.

Talks orchestrated by Goldman Sachs, the investment bank, have now kicked off with prospective buyers, who also include the London-listed media group National World.

Until June, the newspapers were chaired by Aidan Barclay – the nephew of Sir Frederick Barclay, the octogenarian who along with his late twin Sir David engineered the takeover of the Telegraph 19 years ago.

Lloyds had been locked in talks with the Barclays for years about refinancing loans made to them by HBOS prior to that bank’s rescue during the 2008 banking crisis.

The family’s debt to Lloyds also includes some funding tied to Very Group, the Barclay-owned online shopping business.

Ken Costa, the veteran City banker who advised the Barclay brothers on their purchase of the Telegraph in 2004 and counts the sale of Harrods to Qatar Holding among his other flagship deals, is acting as a strategic adviser to the family.

The Telegraph and Spectator disposals are being overseen by a new crop of directors led by Mike McTighe, the boardroom veteran who chairs Openreach and IG Group, the financial trading firm.

Mr McTighe has been appointed chairman of Press Acquisitions and May Corporation, the respective parent companies of TMG and The Spectator (1828), which publish the media titles.

In July, Telegraph Media Group (TMG) published full-year results showing pre-tax profits had risen by a third to about £39m in 2022.

A successful digital subscriptions strategy and “continued strong cost management” were cited as reasons for the company’s earnings growth.

“Our vision is to reach more paying readers than at any other time in our history, and we are firmly on track to achieve our 1 million subscriptions target in 2023 ahead of our year-end target,” said Nick Hugh, TMG chief executive..

“RedBird IMI are entirely committed to maintaining the existing editorial team of the Telegraph and Spectator publications and believe that editorial independence for these titles is essential to protecting their reputation and credibility,” it said in Monday’s statement.

“We are excited by the opportunity to support the titles’ existing management to expand the reach of the titles in the UK, the US and other English-speaking countries.”

Mr Richards could not be reached for comment.