The CEO of the Chubb insurance company on Wednesday defended providing former President Donald Trump with a $91.6 million appeal bond in the civil case where he was found liable for defaming writer E. Jean Carroll after she accused him of rape.

Chubb CEO Evan Greenberg sent a letter to investors, customers, and brokers who expressed concerns about the bond, issued by Chubb subsidiary Federal Insurance Company.

In it, Greenberg wrote that the decision, “has nothing to do with the underlying merits” of the appeal, “or with favoring any of the parties in the case.”

“When Chubb issues an appeal bond, it isn’t making judgments about the claims, even when the claims involve alleged reprehensible conduct,” Greenberg wrote in the letter, which was obtained by CNBC.

“As the surety, we don’t take sides, he said. “It would be wrong for us to do so and we are in no way supporting the defendant. We are supporting and are part of the justice system plumbing included in this case.”

Chubb has been under fire since Friday when Trump revealed he had obtained the appeal bond from the company.

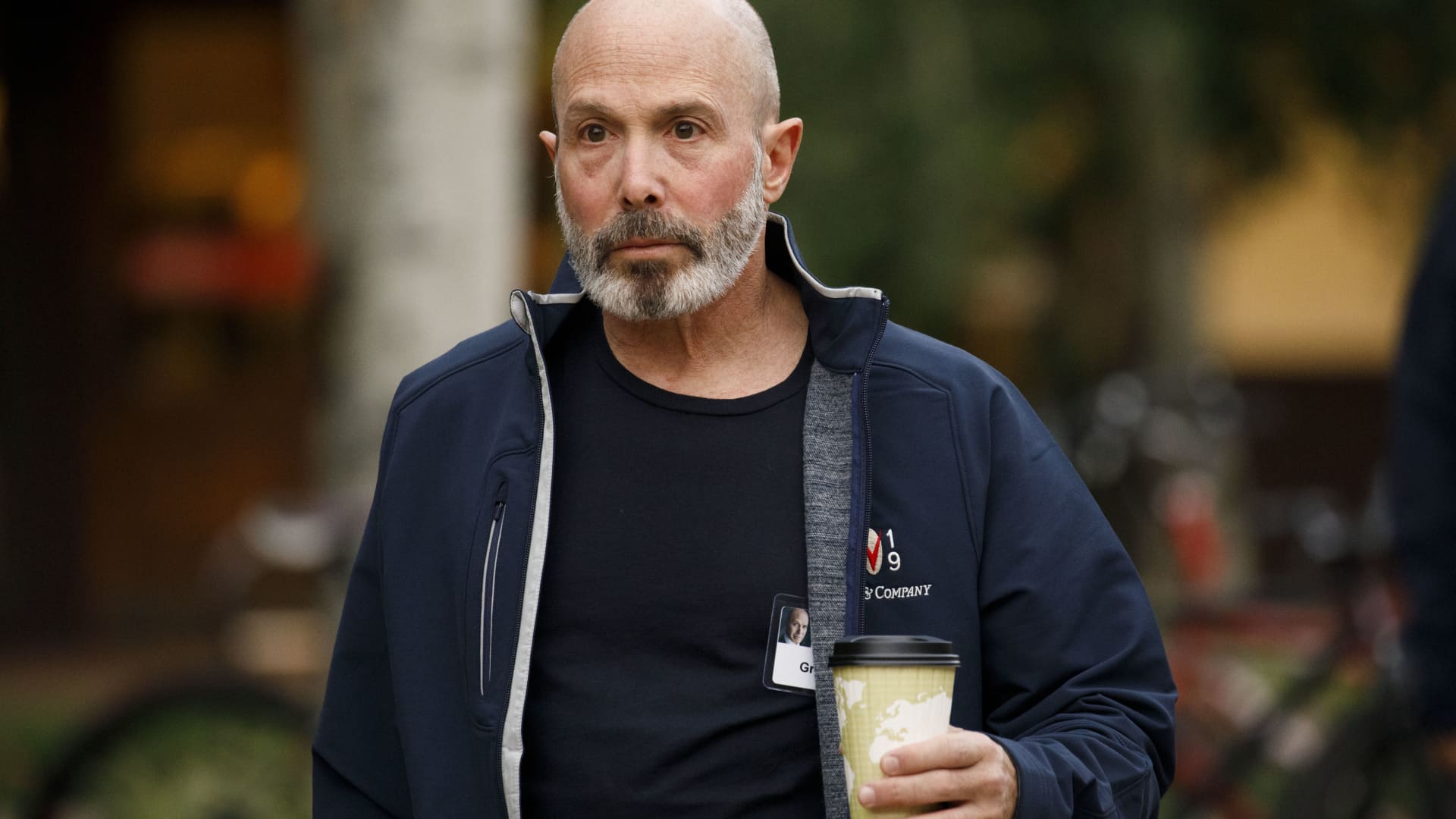

Evan Greenberg, president and chief executive officer of Chubb Ltd., arrives for the morning session of the Allen & Co. Media and Technology Conference in Sun Valley, Idaho, U.S., on Wednesday, July 10, 2019.

Patrick T. Fallon | Bloomberg | Getty Images

If Trump loses his appeal of the defamation judgment, Carroll can demand payment from Chubb. But in the meantime, Carroll cannot collect on the $83.3 million in damages, which a Manhattan federal court awarded her in the case in January.

The reason the appeal bond amount is higher than the original damage award is that it reflects interest on the judgment, which will continue to accrue while Trump seeks to overturn the verdict.

“I fully realize how polarizing and emotional this case and the defendant are and how easy it would be for Chubb to just say no,’ Greenberg wrote in the letter.

“However, we support the rule of law and our role in it. We considered this the right thing to do and we frankly left our own personal feelings aside.”

Greenberg was named by then-president Trump to his Advisory Committee for Trade Policy and Negotiations in October 2018. He continued serving on the panel, which advises the U.S Trade Representative, after Democratic President Joe Biden took office — until March 2023.

In April 2020, Trump named Greenberg and scores of other business executives and experts to so-called Great American Economic Revival Industry Groups to help the U.S recover from the Covid-19 pandemic.

In his letter Wednesday, the CEO said Chubb had protected itself by requiring that Trump’s bond, like any others issued by the company, is “fully collateralized.”

“If the bond is called, then Chubb takes the collateral which is intended to make us whole,” Greenberg wrote. “We hardly support or subsidize defendants or take ‘one for the team.’ “

However, the letter did not say what collateral was used to protect the bond, whose collateral was used, and what Trump paid Chubb as a premium, if anything, to obtain the bond.

The Insurance Journal last week reported that Nick Newton, senior vice president at Assured Partners and immediate past president of the National Association of Surety Bond Producers, said that a premium for an appeal bond is usually between 1% and 2% of the value of the bond, but that it can be negotiated.

If Trump paid the typical premium rate to Chubb, it would have cost him between $916,000 and $1.8 million.

CNBC asked Chubb if Trump separately has sought from the company an appeal bond that could top $500 million against a judgment in the civil business fraud case he lost in Manhattan Supreme Court earlier this year.

The company responded in an email statement, saying, “As a matter of policy, we do not confirm or deny whether we are engaged in business discussions with businesses or individuals.”

In that civil fraud case, Trump and other defendants were found liable for making false statements on financial forms related to his net worth and the values of real estate assets.

Chubb is mentioned in the lawsuit by New York Attorney General Letitia James that led to that judgment.

The suit says that in 2010, a Chubb appraiser had visited Trump’s triplex apartment in Trump Tower in Manhattan as part of the process of underwriting a homeowner’s insurance policy.

Trump himself walked the appraiser through the apartment, and told them he believed the apartment was between 25,000 and 30,000 square feet, even though its actual size was slightly less than 11,000 square fee, the suit said.

Trump also told the appraiser that the master bedroom and a dressing room could not be seen because his wife Melania was sleeping, the suit said.

Trump gave the appraiser just 15 minutes to check the property, according to the complaint.